The market capitalization, i.e. “equity value”, of a company following a stock split or reverse stock split should be neutral in theory. The treasury stock method (TSM) requires the market share price, which we’ll assume is $40.00 as of the latest market closing date. Thus, the “Net Earnings for Common Equity”—which is calculated by deducting the preferred dividend from net income—amounts to $225 million.

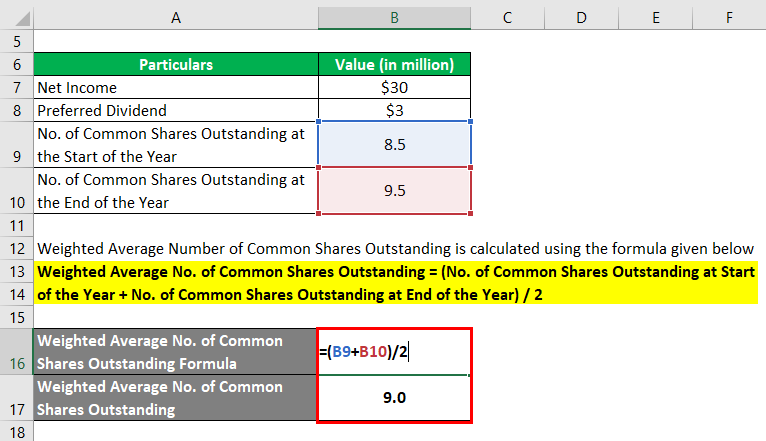

Basic Earnings Per Share Example

If a company misses or beats analysts’ consensus expectations for EPS, its shares can either crash or rally, respectively. Diluted EPS, on the other hand, will always be equal to or lower than basic EPS because it includes a more expansive definition of the company’s shares outstanding. Specifically, it incorporates shares that are not currently outstanding but could become outstanding if stock options and other convertible securities were to be exercised. The disclosures like above help stockholders and other users of financial statements in recognizing the impact of both continuing and discontinued operations on earnings per share of the entity. The earnings per share (EPS) reported by a company per GAAP accounting standards can be found near the bottom of a company’s income statement, right below net income. The net earnings of a company in a given period – i.e. net income (the “bottom line”) – can either be reinvested into operations or distributed to common shareholders in the form of dividend issuances.

How confident are you in your long term financial plan?

What counts as a good EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. Sometimes, a company might report growing EPS, but the stock might decline in price if analysts were expecting an even higher number. Earnings forecasts are based on educated guesswork from analysts and are often too rosy, possibly making the valuation look cheap.

InvestingPro+: Access Earnings Per Share Data Instantly

- And so diluted share count equals 10 million shares plus another 500,000 (the 1 million shares underlying options, less than 500,000 theoretically repurchased).

- The most crucial aspect of earnings per share comprehension is knowing how to do the calculation.

- Preferred stock can be issued as noncumulative and cumulative preferred stock.

- Diluted EPS, which accounts for the impact of convertible preferred shares, options, warrants, and other dilutive securities, was $1.56.

However, it would help if you also looked at other financial ratios like return on total assets, ROCE, diluted EPS, and the statements like cash flow and fund flow statements. Since the company has prepared the income statement and the balance sheet, it may have manipulated the data to showcase a good reputation to its potential investors. One of the ways to make an informed investment decision is to compare the EPS figures for one company over a long time period. You can also compare EPS values for a few companies within the same industry to choose the most profitable one.

For an illustrative, real-life example, the following screenshot below is of the income statement of Apple (AAPL) from its 10-K filing for fiscal year ending 2022. The distinction between the basic and diluted EPS can be seen in the denominator of their respective formula. In fact, a trailing EPS is calculated using the previous four quarters of earnings. While EPS is a widely used and essential tool, it has several limitations and can be easily misinterpreted. When evaluating a company, it’s important to consider other profitability measurements as well. Companies can also mislead investors by reporting “adjusted” EPS and removing certain expenses from the calculation.

Shareholders might be misled if the windfall is included in the numerator of the EPS equation, so it is excluded. That year the company did not issue additional shares but repurchased 40 million shares during the second half of the year. The investors wanted to know their Basic EPS and applied the formula again. Yes, it can talk about how much net profit a company has square + xero been earning, whether a company is generating higher yields, and whether one company is doing better than another in terms of earnings per share. But you should know that EPS alone cannot depict a great deal about a company’s financial health. While looking at a company and its EPS, you should look separately at the net profit and the outstanding equity shares.

If a company repurchases shares, its share count will decline, which reduces basic share count during that period. If, in contrast, it issues shares to employees or in consideration for an acquisition, the share count will increase. Investors should also be aware that companies can sometimes manipulate their reported earnings per share by using accounting techniques such as aggressive revenue recognition or creative expense management. When a company has enough profit to pay shareholders but chooses not to, Retained earnings per share is the amount of money that would have gone to shareholders. The reported earnings per share are calculated using generally accepted accounting principles. The company declares this during its filing with the Stock Exchange Commission.

In that case, the options are excluded because they would increase the diluted share count — and thus actually decrease the loss per share. In that event, the higher diluted share count is making the business look better than it might otherwise be. The accounting rules applied to diluted shares aim to prevent that outcome. The diluted share count differs from the basic share count in that it adds shares that aren’t yet issued — but could be.

Earnings per share is an extremely vital business statistic used to entice, persuade, and demonstrate to investors the advantages of putting their money into a particular firm. The share price of a stock may look cheap, fairly valued or expensive, depending on whether you look at historical earnings or estimated future earnings. Ultimate Company is a technology firm that has been operating for 5 years. Their 2015 report showed that the business produced a net income of $110 million after all costs, expenses, interest charges and taxes were deducted from net revenues.